#kanzlei

Kanzlei

As a middle-sized firm most of our work is notarial and we cover the full range of Notary’s work, in particular Real Estate, company and Probate matters. Our two Notaries / Solicitors work almost entirely in the Notaries’ Office. Together with a current total of 10 committed and expert staff we ensure that the performance of our notarial services is swift and problem-free.

We would be very happy to assist you with the most important contracts in your life and ensure that they are carefully notarised and professionally processed.

However our services also include legal services as lawyers: advising and representing you in Civil Law matters especially in Company Law, Real Estate, Probate and in representing you in taxation disputes with the Tax Office and at the Tax Courts.

Prof. Dr. M.J. Neumann

Reinhard Nasdal

kompetenzen

Areas of Practice

Probate and Gifts

Good to know: Everything is sorted

We advise and assist you in all notarisations and questions in connection with inter vivos gifts but also with protection of assets before death and with all questions of Probate law and drawing up wills and inheritance contracts.

We will be glad, with your help, to find the right solution for you, tailor-made to your wishes – even in cases where the gifts / inheritances are not straightforward, which involve e.g. foreign assets, participations in companies and partnerships, mortgaged Real Estate, various patchwork or divorce situations, provision for minors, arrangements to avoid disputes amongst heirs etc.

We shall also advise you on the law on statutory portions, execution of wills, questions of inheritance and gift tax, company and partnership arrangements, securing the interests of spouses and children, safeguards for the donor of gifts, e.g. by agreeing reclaim rights.

Whilst a covenant of gift normally has to be notarised (§ 518 Civil Code (BGB)) notarisation is not prescribed for Wills. We shall be happy to advise you on whether in a particular case notarisation would be in your interests.

Businesses, Partnerships and Corporations

On the right track from the outset

Anyone who sets up a Company or Partnership, or who participates in one, usually needs legal advice, whether on the legal form, the internal organisation (the shareholders’ meeting) or corporate actions. Notarisation is not prescribed for all forms of company or partnership, but normally registration in the Commercial Registry is required, and the application has to be certified by a Notary.

We shall be happy to advise you and draw up articles of association / partnership agreements and shareholder resolutions for the appropriate form of entity for you and to develop with you and if necessary together with your Tax Consultant long-term solutions so that the company remains legally and commercially able to act in cases of entrepreneurial growth, or joining or retirement of partners or shareholders.

But even if you have already chosen a legal form, which is not or which is no longer appropriate for your business, we shall be glad to assist you as acting Notaries in the transformation into another form (merger, split, spin-off, change in legal form). Or would you like to bring your children into the business, transfer assets in the form of investments in companies in the family and regulate the succession in the event of death? Talk to us: we shall find a solution.

Marriages and Domestic Partnerships

Providing for good times and bad.

We shall be happy to advise you and to draft a pre- or post-nuptial agreement suited to the form of your marriage, your asset position, income and pension, but also bearing in mind future developments (e.g. having children).

Nuptial agreements must be notarised and may be made before or after the marriage is concluded. It may be necessary to draw one up during the marriage, because the marriage form has changed or in a crisis situation. The tax and Probate consequences must always be borne in mind.

As Notaries we are also happy to assist you when it is a question of taking precautions for cases of sickness. Powers of attorney extending to care, health care proxies and living wills are today routine areas of notarial advice.

Real Estate

Your Property – our Experience

Houses and land are an important part of their assets for most people, as well as a preferred form of investment.

Commonhold properties are becoming more and more popular in towns. In addition to the special rights of ownership in the individual flat, each unit-holder simultaneously owns a share in the building and the land (the so-called common property). Ownership of a flat derives from partition of the land under the Commonhold Act and is normally acquired by contract of sale.

The relationship of the unit-holders to each other and the user, management and maintenance of the common property is a potential source of disputes.

In particular in large towns such as Berlin commonholds are purchased both in new-builds and in renovated old housing stock. If a purchaser acquires a commonhold unit here, it is often done by way of a “Builder’s Contract,” a legal form posing a challenge both to the parties and to the Notary. Notarial drafting and processing is here especially important.

Potential legal and tax risks can be avoided in advance if they are perceived and dealt with.

After drafting and notarising the contract our work is not finished – indeed it might be said that is when it begins:

After notarisation we as a Notary’s office deal with the procedure with the authorities involved, your financing and/or superseded bank and the Land Registry so that you as purchaser are registered in the Land Register or as vendor receive the purchase price.

Our staff are thoroughly experienced in processing a large number of Real Estate contracts. Together with our expert team we try to ensure that the property is quickly and securely transferred.

Profit from our many years of experience in Real Estate transactions – even if it is a complicated case. We do complicated cases as well!

Real Estates and Taxes

Planning ahead to avoid surprises

Private sale or commercial property deal, listed buildings and buildings in renovation areas, Real Estate transfer tax, avoiding the badge of trade for a limited partnership where the general partner is a corporation, relief for Real Estate under inheritance tax rules, etc. etc. – there are many tax aspects to Real Estate.

We shall be happy to advise you on tax in all your questions relating to Real Estate or companies and partnerships holding Real Estate. Arranging and planning in good time may avoid nasty surprises and disputes with the tax office later on. That is our aim.

And if you cannot avoid a dispute, we shall be happy to represent you vis-à-vis the tax authorities and before the tax courts.

Our Team

Mrs Hentschel-Knitt

Reception

Mrs Reddig

Reception/Office Management/Accounting

Mrs Steinbeck

Notary clerk

Mrs Axt

Notary clerk

Mr Baatz

Notary clerk

Mrs Preuß

Notary clerk

Mrs Ruch

Notary clerk

Mrs Stahn

Notary clerk#kontakt

Contact

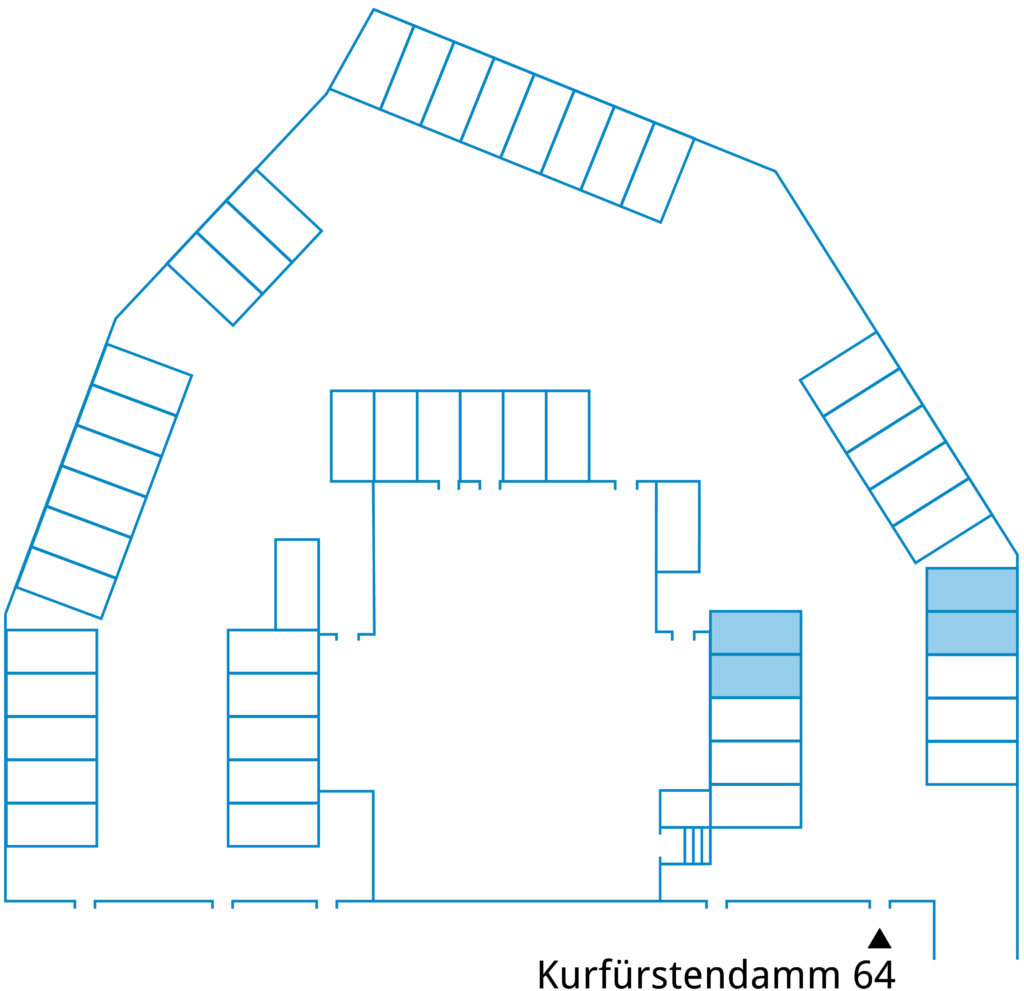

Kurfürstendamm 64

10707 Berlin

Telephone: +49 30 884 201-1

Fax: +49 30 884 201-20

E-Mail: info@kanzlei-neumann.com

Business hours:

Monday to Thursday from 9:00 AM to 6:00 PM

Friday from 9:00 AM to 3:00 PM

Underground (Adenauer Platz, U 7)

Parking spaces are available in the courtyard (entrance to the right next to the foot entrance to Kurfürstendamm 64)